Twice a year, we survey landlords and tenants using our service to gather their thoughts and experiences on renting. This feedback provides a temperature check of attitudes towards the rental market, offering unique insights into changes in the Private Rented Sector (PRS) and what matters to tenants and landlords.

Our half-yearly PRS review combines stakeholder opinions and feedback with market statistics and tenancy data, providing a comprehensive overview of the evolving rental market and attitudes towards the PRS, including future trends.

As the largest provider of deposit protection services in England and Wales, The DPS supports landlords and tenants with a simple, easy-to-use service and top-rated customer experience.

The tenancy deposit market

- Difficulties for tenants and landlords mentioned in the PRS report December 2024 continue into 2025

- The Renters' Rights Bill and Energy Performance Certificates (EPC) legislation continue to hang over the market, driving uncertainty among landlords

- A lack of suitable available properties, combined with high rents and difficulty saving for a deposit, remain connected, core issues for many renters

- Tenants are concerned with being able to save enough to become homeowners

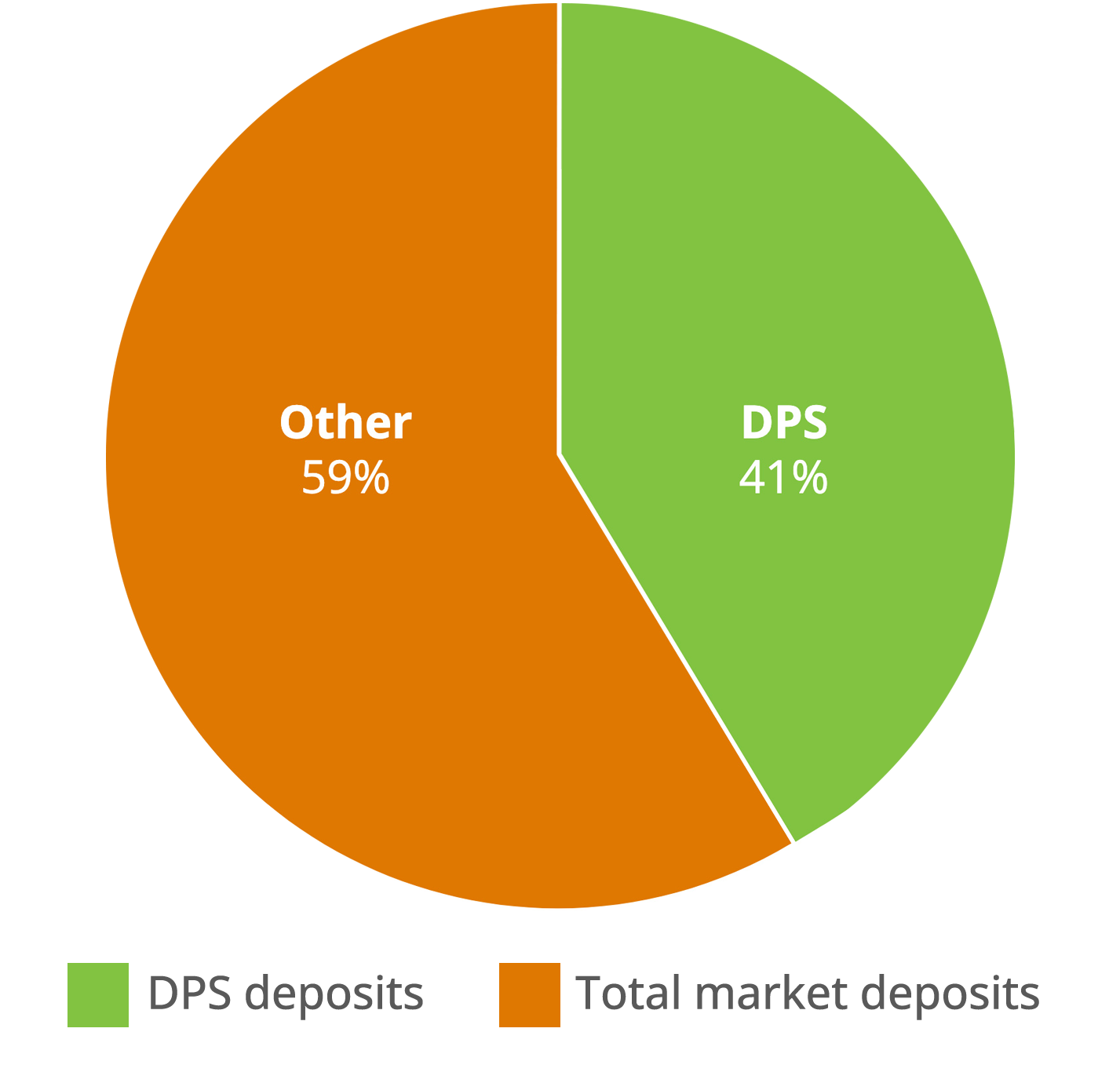

With 1.92 million deposits under our care — 41% of the market — The DPS is the largest deposit protection provider in England and Wales.

The tenancy deposit market has seen a gradual shift towards Custodial deposit protection, with 54.4% in Custodial schemes, but the rate of change is slowing.

Market size - March 2025*

Based on 4.71 million deposits

Though the number of tenancies in England and Wales continues to grow, the rate has slowed. In the last 12 months, deposits protected increased by just over 82,000, marking the second time in eight years the rental market grew by less than 100,000 tenancies in a year, and less than a third of the 270,000 increase in 2017.

What could be driving the tenancy slowdown?

Nearly a quarter of surveyed landlords are considering selling all their properties and leaving the PRS. Reasons they cite include:

- Increased legislative burdens.

- Changes in capital gains tax, reducing the annual exempt amount and increasing the tax burden when selling a rental property.

- higher interest rates, reducing affordability and driving up mortgage costs.

These factors, collectively or individually, could impact generating returns from their property portfolios. For some, the effort required to operate may now outweigh the benefits.

The cost of being a tenant

Affordable rent continues to remain a talking point for tenants, though there are some signs the impact is softening. Rents are likely to have risen in line with average deposit values. Deposits are typically linked to the cost of renting, with legislation allowing the maximum deposit value to be equivalent to five weeks' rent.

Our data indicates the factors driving increased rents include increasing costs to landlords due to legislation changes, higher maintenance costs and maintaining rental values in line with local markets

Rising rental costs appear to be a key reason behind tenants staying in their properties longer. Our data shows average tenancy lengths continue to grow, now standing at just over two years and 11 months (1,061 days), up 155 days from 2024 and over nine months longer than in 2021.

Higher rents for new tenancies, increased moving costs and difficulty finding suitable properties - driven perhaps by the year-on-year slowdown in the number of properties added to the market - appear to be extending the amount of time tenants are staying in their rentals. In addition, as mortgage rates have increased and property purchase prices continue to rise, the challenge of home ownership becomes greater.

We believe the result of a combination of these factors is a decrease in the number of tenants who have moved in the last six months.

Rising cost of the average deposit*

Increase in the average tenancy length (in days)*

More from the PRS review

NEXT: The landlord's view

The tenant's view

Download the PRS review

*Source: MHCLG - TDP Six Monthly Report March 2025

What is the Private Rented Sector review?

Twice a year we ask landlords and tenants that use our service for their thoughts and experiences of renting. Based on the feedback they give, we collate a temperature check of attitudes towards the rental market. This gives us unique insights into how the Private Rented Sector (PRS) is changing and what's important to tenants who rely on the rental market and landlords needing the income their properties generate.