The landlord's view

Every six months we survey our landlords with a range of questions about their lettings portfolios and their experience of the market, the challenges they face and their future intentions. Over 1,100 landlords responded to our latest survey, sharing their thoughts and opinions.

Property portfolios

These respondents reflect a range of different backgrounds, from those with large portfolios working full time as landlords, to those with a single property that was perhaps never intended to be a rental.

Of the 1,115 who replied:

63%

purchased all their properties specifically for use as rentals

16%

either inherited their rental property or originally bought their rental as their main home

47%

own one or two properties, with another 34% owning between three and ten properties

54%

have another primary source of income, with 39% stating rental income remains their main source of income

52%

are considering selling some or all of their portfolio (up 5% from October), with 25% of these considering fully exiting the market within two years

Number of properties landlords own

The results are based on a series of landlord surveys (waves) The DPS conducted over the past 12 months.

The graph shows the number of properties each landlord owns. In our latest wave, 47% of landlords own one or two properties.

How landlords have acquired their rental properties

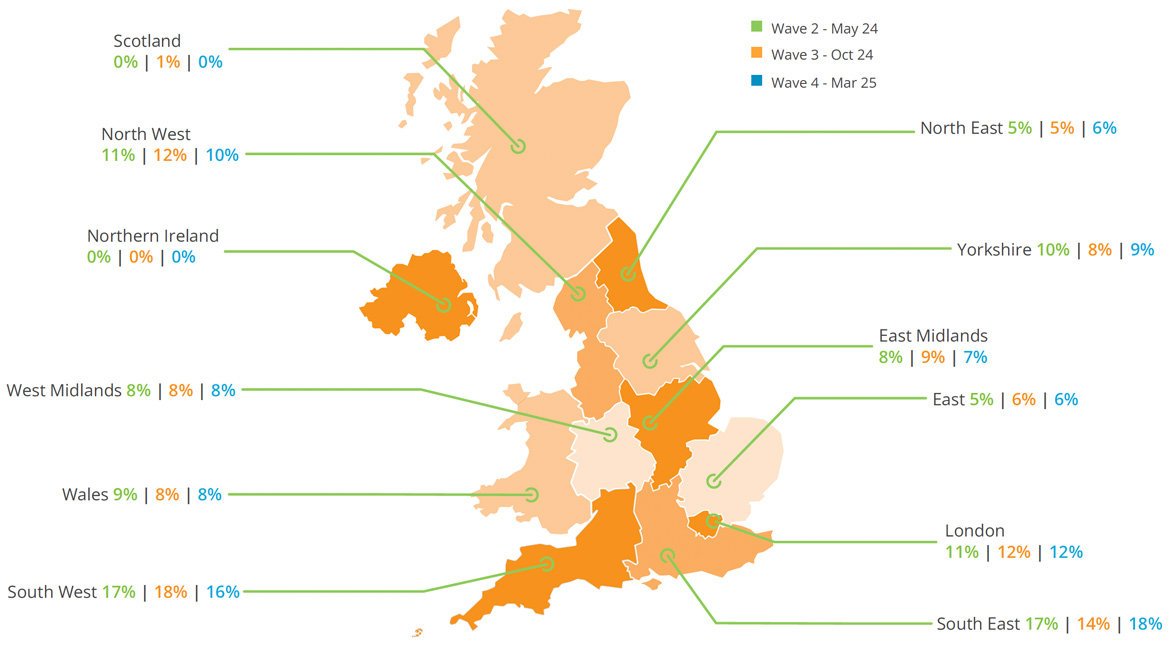

Rental property locations throughout the UK

Legislative uncertainty drives landlord concerns

The forthcoming Renters' Rights Bill remains a concern for landlords, with many unsure how it will impact their business, or the specific steps they may need to take to comply. This, alongside other recent legislation, taxation and interest rate concerns, is leading many with smaller portfolios to question whether it's worthwhile staying in the PRS.

Conversely the data suggests full time landlords operating their property portfolios as their primary source of income are less inclined to leave the PRS. Of the landlords with three or more properties, 78% aren't considering selling all their properties in the next one to two years. This rises to 80% for those with six or more properties.

Of the landlords considering buying more properties, 4% recognise the demand for rental property remains strong. While small scale landlords selling their properties could be creating opportunity for private buyers, those buyers are likely to be competing against professional landlords looking to increase their portfolios.

Of the landlords who indicated they were considering selling some or all of their properties:

89% said changes or proposed changes in legislation or regulation are influential in the intention to sell, unchanged from Oct 2024

74% said the level of returns after tax no longer makes operating in the PRS an attractive proposition, also unchanged from Oct 2024

While most landlords manage their properties simply as a landlord, a large percentage choose to operate their portfolio as a business, either as a sole trader or a limited company.

How landlords structure their rental portfolios

Are rental properties the main source of income for landlords?

Raising rents and advance payments

The number of landlords raising rents in the past 12 months has slightly decreased, while those planning to increase rents in the next six months has risen.

Since May 2024, 45% raised rents (down from 48%), 16% plan to increase rents in the next six months (up 2%), and 16% within 6 to 18 months (no change).

21% plan to keep rents unchanged, up 3% since May 2024. Key drivers for rent increases include legislation, maintenance costs and aligning with local markets.

Landlords have also told us the number of tenants putting in offers above the asking rent stands at 15%, 2% lower than the same point last year but up by 1% since our wave 3 survey.

The changes in both the amount of rent being taken upfront, and the volume of tenants submitting “above asking rent” offers to secure a tenancy perhaps indicates a cooling in demand for rental properties. Although this is in conflict with the view that many landlords are considering exiting the market, or at very least divesting some of their rental portfolios.

Landlord plans for rent increases

Factors driving landlords to increase rents

Is demand for rental properties changing?

55% of landlords responding to our survey said they'd offered at least one property for rent. Of these:

35%

said there was no change in the number of people applying to rent their property

36%

said the number of people applying to rent their property has increased but hasn't doubled

16%

said the number of people applying to rent their property has roughly doubled

13%

said the number of people applying to rent their property has more than doubled

More from the PRS review

NEXT: The tenant's view

Download the PRS review

The tenancy deposit market

What is the Private Rented Sector review?

Twice a year we ask landlords and tenants that use our service for their thoughts and experiences of renting. Based on the feedback they give, we collate a temperature check of attitudes towards the rental market. This gives us unique insights into how the Private Rented Sector (PRS) is changing and what's important to tenants who rely on the rental market and landlords needing the income their properties generate.