Twice a year, we survey landlords and tenants using our service to gather their thoughts and experiences on renting. This feedback provides a temperature check of attitudes towards the rental market, offering unique insights into changes in the Private Rented Sector (PRS) and what matters to tenants and landlords.

Our half-yearly PRS review combines stakeholder opinions and feedback with market statistics and tenancy data, providing a comprehensive overview of the evolving rental market and attitudes towards the PRS, including future trends.

As the largest provider of deposit protection services in England and Wales, The DPS supports landlords and tenants with a simple, easy-to-use service and top-rated customer experience.

The tenancy deposit market

Our latest data indicates the Private Rented Sector (PRS) has entered a period of relative consistency ahead of the implementation of the Renters' Rights Act that recently received Royal Assent.

The 6 months from March to September 2025 saw the second lowest growth in new tenancies since we started gathering data in 2016. Only the post COVID period of March to September 2022 saw fewer tenancies added to the market. The proportion of tenants moving within the last 12 months has remained steady at 10%, the same level as March 2025 and down 3% compared with the same period last year (October 2024).

Of those tenants who moved:

- 59% told us they'd paid higher rent to secure a new property, down 4% since March

- 27% had to move to a cheaper area, also down 4%

- 33% had to downsize, up 5%

- 29% had to move further away from work, up 3%

Of those having to pay higher rent, the proportional increase largely stayed the same. The notable exception came in the lowest range of increase (up 0-10% of previous rent) with 22% reporting a change within this range of increase compared to March 2025, while at the other end of the scale, those reporting the highest range of increase fell from 10% in March to 5%.

This relative market consistency described by tenants over the last two surveys is also reflected in the landlord responses to our surveys.

- 43% of landlords have increased rent in the past year, a slight decrease on previous waves

- 53% of landlords are considering selling some or all of their properties in the next one to two years, the same as in March 2025

- 41% don’t plan to change their property portfolios in the next one to two years

- 3% plan to buy more properties

Landlords considering selling cited proposed changes in legislation as the key factor, remaining steady at 89%. Capital Gains Tax changes remain influential for 90% and the Renters’ Rights Act a consideration for 89%.

Market size - September 2025*

Based on 4.72 million deposits

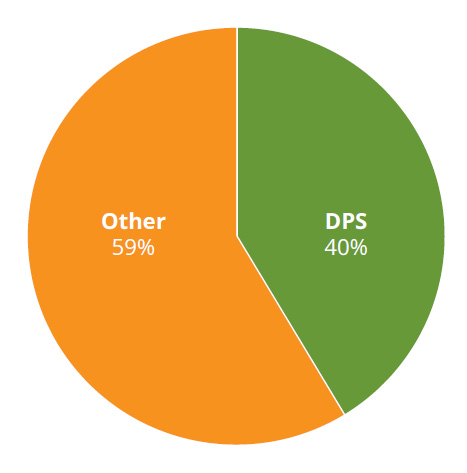

With 1.87 million deposits under our care - 40% of the market - The DPS is the largest deposit protection provider in England and Wales.

Market share - Custodial vs Insured accounts*

The tenancy deposit market has in recent years seen a gradual move towards Custodial deposit protection, but this shift has stalled in the last 24 months with 54.0% held in Custodial schemes compared to 54.6% two years.

The last 6 months saw the second smallest half-yearly growth in the number of deposits protected since our records began, increasing by just under 17,000 tenancies. Combined with the previous 6 months, the annual number of new tenancies is the lowest year-on-year growth in the last 10 years, and corresponds with our survey findings that tenants are moving less frequently.

Rental market growth rate, based on number of deposits protected*

What's behind the period of marketplace stability we've seen over the last 12 months?

While the cost of living and associated renting costs remain high in relation to wages overall, The Bank of England base interest rate has decreased by 1.5 percentage points since the start of 2024, to 3.75% as of 18 December 2025. This in turn is driving down the cost of mortgages and the need for landlords to increase rent to cover rising mortgage costs.

In 2025, we've also seen the progression of the Renter's Right's Bill through parliament. Uncertainty over how the changes may affect the market has been a common theme among landlord responses and has potentially led to a deep breath while waiting to understand what the regulatory changes will actually entail.

With the Act having received Royal Assent, the marketplace moves into a phase of learning about its complexities and the timing of changes it will need to make including:

New administrative processes for tenancy agreements and rent reviews

The updated Section 8 notice

A tenant's right to request pets and preparing for this change

New obligations for landlords and letting agents

The Decent Homes Standard

Awaab's Law

While the timing of implementation of some of the elements above varies, the Renters' Rights Act is scheduled for implementation in May 2026. This is the biggest single piece of legislative change to impact the PRS for many years. How the market now adjusts and reacts to these changes will be keenly watched by all market participants. It will need time for the PRS to learn how it will work in practice and we to evolve to accommodate the requirements of the Act. We'll use future editions of this report to keep our stakeholders informed of sentiment.

The cost of being a tenant

Though the growth in tenancies added to the PRS is low from a deposit value perspective, a continued rise indicates the average cost of renting continue to increase. Average deposit value in the UK now stands at £1,195, up from £1,175 in our last report and £1,150 in September 2024. With the deposit cap tied to rental values, it implies a monthly average rent of around £1,035 and an annual increase of 3.9% from September 2024 to September 2025.

*Source: MHCLG - TDP Six Monthly Report December 2025