The landlord's view

Every six months we survey our landlords with a range of questions about their lettings portfolios and their experience of the market, the challenges they face and their future intentions. In our latest survey, 1,264 landlords responded, sharing their thoughts and opinions.

Property portfolios

These respondents reflect a range of different backgrounds, from those with large portfolios working full time as landlords, to those with a single property that was perhaps never intended to be a rental.

Of the 1,264 who replied:

65%

purchased all their properties specifically for use as rentals

17%

either inherited their rental property or originally bought their rental as their main home

50%

own one or two properties, with another 42% owning between three and ten properties

56%

have another primary source of income, with 36% stating rental income remains their main source of income

53%

are considering selling some or all of their portfolio (no change from March 2025), with 26% of these considering fully exiting the market within two years

Number of properties landlords own

The results are based on a series of landlord surveys (waves) The DPS conducted over the past 12 months.

The graph shows the number of properties each landlord owns. In our latest wave, 50% of landlords own one or two properties.

How landlords have acquired their rental properties

Wave 3 (Oct 2024)

- I purchased the property / properties specifically to rent them out (61%)

- My rental properties are a mixture of the above (16%)

- The property I rent out was my main address / home before moving elsewhere (14%)

- I inherited the property / properties I rent out (6%)

Wave 4 (March 2025)

- I purchased the property / properties specifically to rent them out (63%)

- My rental properties are a mixture of the above (17%)

- The property I rent out was my main address / home before moving elsewhere (12%)

- I inherited the property / properties I rent out (4%)

Wave 5 (Oct 2025)

- I purchased the property / properties specifically to rent them out (65%)

- My rental properties are a mixture of the above (15%)

- The property I rent out was my main address / home before moving elsewhere (12%)

- I inherited the property / properties I rent out (5%)

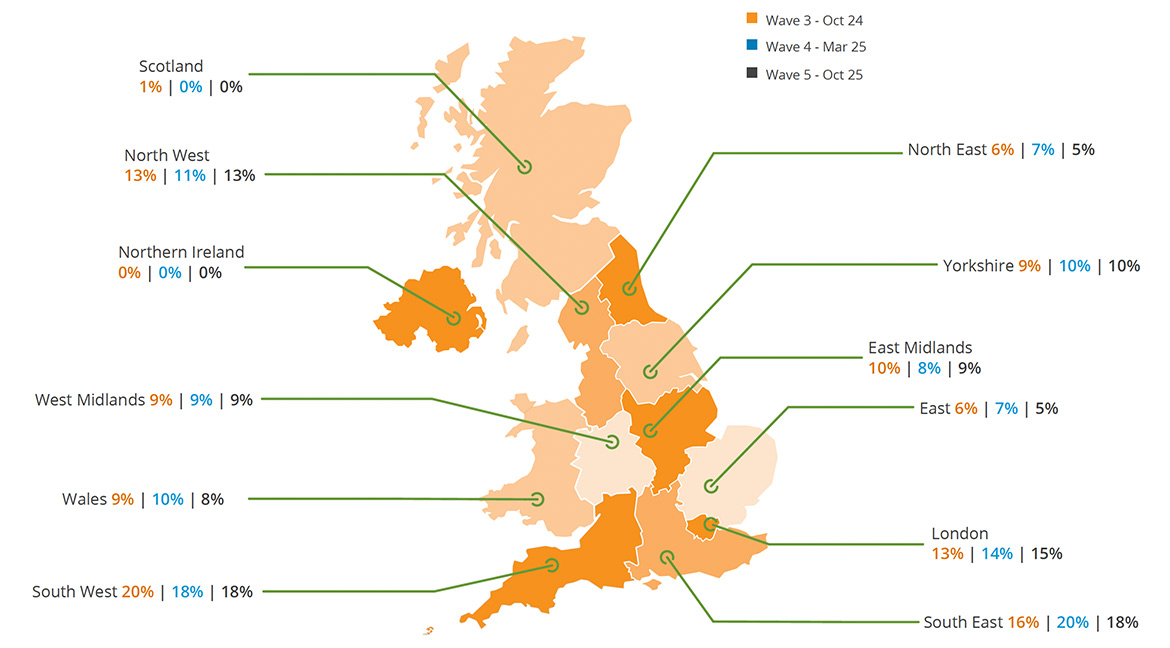

Respondent locations throughout the UK

Raising rents and advance payments

The number of landlords raising rents in the past 12 months has slightly decreased, while those planning to increase rents in the next 6 months has also fallen, potentially a reflection of falling mortgage and operating costs. A rise in landlords expecting to increase rents in the next 6-18 months may reflect a “wait and see” attitude to how the changes required by the Renters’ Rights Act affects their lettings operations.

Since March 2025, 51% of respondents raised rents (down from 53%), 17% plan to increase rents in the next 6 months (down from 21% in March), though 25% plan to raise rents within 6 to 18 months (up from 19%).

24% plan to keep rents unchanged, a 1% fall since March 2025. The top three drivers for rent increases remain legislation, maintenance costs and aligning with local markets.

Landlord plans for rent increases

Factors driving landlords to increase rents

Landlords have also told us the number of tenants putting in offers above the asking rent stands at 16%, up by 2% since our October 2024 survey.

As affordability has improved and letting costs and mortgage costs have fallen, the market appears to have entered a period of stability.

With the Renters Rights Act having received Royal Assent, the marketplace is moving into a phase of learning about its complexities and readying for changes needed. How the market now adjusts and reacts to these changes will be keenly watched by all market participants.

Landlord portfolio objectives

We asked landlords what their plans were for their small and large property portfolio in the next one to two years.

Small portfolio (1-2 properties)

Large portfolio (3 or more properties)

Top three factors driving landlords to sell their properties

Small portfolio (1-2 properties)

Wave 3 (Oct 2024)

- Legislation (88%)

- Return (76%)

- Mortgage costs (45%)

Wave 4 (March 2025)

- Legislation (88%)

- Return (74%)

- Problem tenants (44%)

Wave 5 (Oct 2025)

- Legislation (87%)

- Return (76%)

- Retirement (44%)

Large portfolio (3 or more properties)

Wave 3 (Oct 2024)

- Legislation (92%)

- Return (77%)

- Mortgage costs (51%)

Wave 4 (March 2025)

- Legislation (92%)

- Return (73%)

- Retirement (49%)

Wave 5 (Oct 2025)

- Legislation (97%)

- Return (81%)

- Mortgage costs (44%)

Is demand for rental properties changing?

49% of landlords responding to our survey said they offered at least one property for rent. Of these:

21%

said there was no change in the number of people applying to rent their property, an increase of 2% since March 2025

16%

said the number of people applying to rent their property has increased but hasn’t doubled, down 4%

5%

said the number of people applying to rent their property has roughly doubled, down 2%

7%

said the number of people applying to rent their property has more than doubled, down 2%

For a more in-depth view of all landlord statistics, please view the full Private Rented Sector review PDF.